Current Price Action

As of July 29, 2025, the Nasdaq 100 E-mini Futures (NQ) show mild bearish pressure on intraday charts:

- 1-Hour Chart: Closed at 23,470 (-0.14%), testing support near 23,460–23,470. The RSI at 34.34 signals oversold conditions.

- 15-Minute Chart: Traded flat (-0.02%) with RSI at 32.21, reinforcing short-term exhaustion in selling momentum.

The charts reveal a consolidation phase after a rally to all-time highs earlier in July. Key technical observations:

- Support Zone: 23,460–23,470 is critical. A break below could target 23,400.

- Resistance: 23,500–23,520 (yesterday’s high) caps upside moves.

- RSI Divergence: Oversold readings on both timeframes hint at a potential near-term bounce.

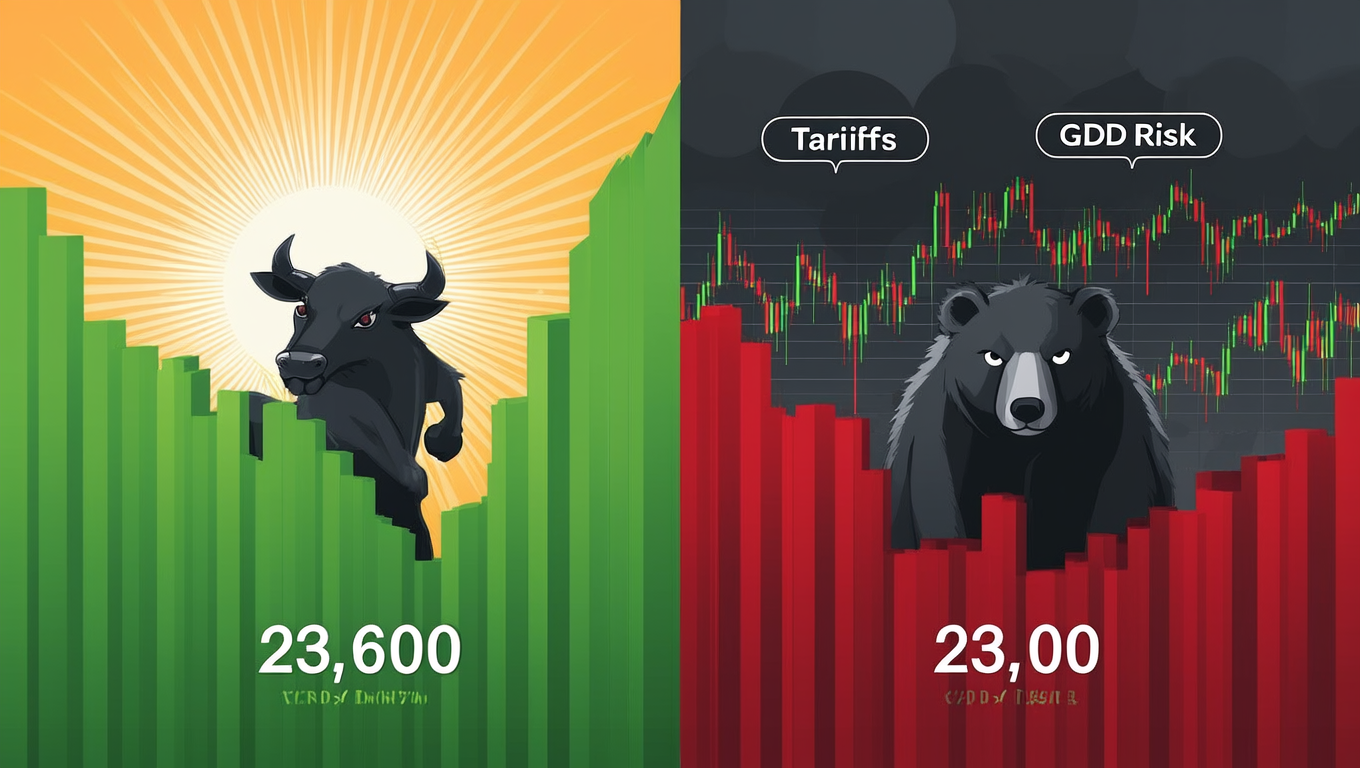

Where Is Price Headed Next?

Short-Term (1-3 Days):

- Expect a technical rebound toward 23,500–23,520 if support holds. The oversold RSI and tight trading range suggest buyers may step in.

- A close above 23,520 opens the path to retest July highs near 23,600.

Risk Scenario:

Failure to hold 23,460 could trigger a slide to 23,400. However, the lack of strong bearish volume suggests downside is limited.

Economic Headwinds: Tariffs and Growth Concerns

Recent economic updates add complexity:

- Tariff Impacts:

- New U.S. tariffs (effective July 27) now average 18.2%—the highest since 1934 (Yale Budget Lab, July 28).

- These tariffs could reduce 2025 GDP growth by 0.5% and raise inflation, per Yale’s model.

- GDP Contraction:

- Q1 2025 GDP shrunk by 0.5% (BEA, June 26).

- Q2 data (due July 30) is forecasted at +3%, but tariff-driven import surges may distort results (CBS News).

- Federal Reserve Policy:

- Rates are likely to hold at 4.25–4.50% until September. The Fed seeks “clearer signs of labor market weakening” before cutting (EY).

- Corporate Vulnerability:

- EY notes the economy relies on a “narrow base” of high-income consumers and large firms—making growth “fragile.”

Trading Strategy for Beginners

- Entry: Consider long positions near 23,460 with tight stops below 23,450. Target 23,500–23,520.

- Confirmation Needed: A break above 23,520 with rising volume validates bullish momentum.

- Risks: Avoid aggressive bets if Q2 GDP (July 30) misses estimates or tariff retaliation escalates.

The Bigger Picture

While tech stocks remain resilient, the Nasdaq faces dual pressures: short-term profit-taking and tariff-driven economic uncertainty. A decisive close above 23,600 would signal renewed bullish conviction. Until then, patience and tight risk management are key.

Stop Navigating Choppy Markets Alone.

🦈 Join Sharks Frenzy today and trade with our pod.

- Real-time forex alerts at key support/resistance levels

- Live breakdowns of economic data (GDP, tariffs, Fed moves)

- Beginner-friendly education on price action + RSI strategies

Leave a Reply