Bitcoin’s New All-Time High: A Closer Look

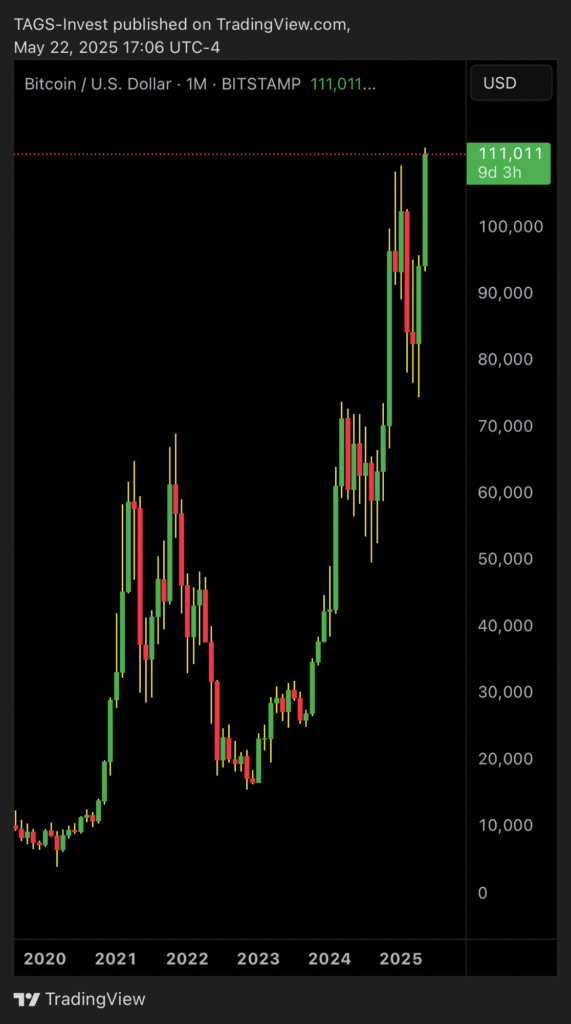

On May 22, 2025, Bitcoin (BTC) achieved a record price of $111,878, marking a significant milestone in its history. This surge is attributed to several key developments.

Institutional Adoption: Major financial institutions, including JPMorgan Chase, have begun offering Bitcoin to clients, signaling mainstream acceptance .

Regulatory Progress: The U.S. Senate’s advancement of a stablecoin regulation bill has provided a clearer legal framework, boosting investor confidence.

Corporate Investments: Companies like MicroStrategy have significantly increased their Bitcoin holdings, with MicroStrategy’s investment totaling over $63 billion.

These factors have collectively propelled Bitcoin’s market capitalization to approximately $2.2 trillion, making it the fifth-largest asset globally, surpassing Amazon.

Historical Patterns: What Happens After New Highs?

Analyzing Bitcoin’s past performance reveals a pattern of significant growth following previous all-time highs.

2013: After surpassing $1,000, Bitcoin experienced a substantial rally before correcting.

2017: Breaking the $19,000 mark led to increased volatility but also set the stage for future gains.

2021: Reaching nearly $69,000, Bitcoin’s price eventually corrected but laid the groundwork for institutional interest.

These patterns suggest that while corrections are common, new all-time highs often precede longer-term upward trends.

Future Price Targets: Realistic Projections

Considering Bitcoin’s current market position and historical trends, several realistic price targets can emerge.

Short-Term: Analysts predict a potential rise to $118,000, contingent on sustained momentum.

Mid-Term: Projections estimate Bitcoin could reach between $135,000 and $200,000 by the end of 2025, driven by continued institutional adoption and macroeconomic factors.

Long-Term: Some forecasts suggest Bitcoin could attain valuations of $500,000 to $1 million within the next decade, assuming it captures a larger share of the global financial market.

These projections are based on current market dynamics and Bitcoin’s increasing integration into traditional financial systems, rather than speculative interest from new retail investors.

Bitcoin’s Role in the Global Financial Landscape

Bitcoin’s rise to a $2.2 trillion market cap reflects its growing significance in the global economy. As a decentralized asset, it offers an alternative to traditional financial instruments, appealing to investors seeking diversification and a hedge against inflation. Its limited supply and increasing demand position it as a potential store of value akin to digital gold.

However, Bitcoin’s future trajectory will depend on several factors below:

Regulatory Developments: Clear and supportive regulations can foster adoption, while restrictive policies may hinder growth.

Technological Advancements: Improvements in scalability and transaction efficiency can enhance usability.

Market Sentiment: Investor confidence, influenced by macroeconomic conditions and institutional involvement, will play a crucial role.

Conclusion

Bitcoin’s recent achievement of a new all-time high underscores its evolving role in the financial world. While historical patterns suggest potential for further growth, investors should remain cognizant of market volatility and external factors influencing price movements. As Bitcoin continues to mature, its integration into the global financial system will likely shape its long-term value and stability.