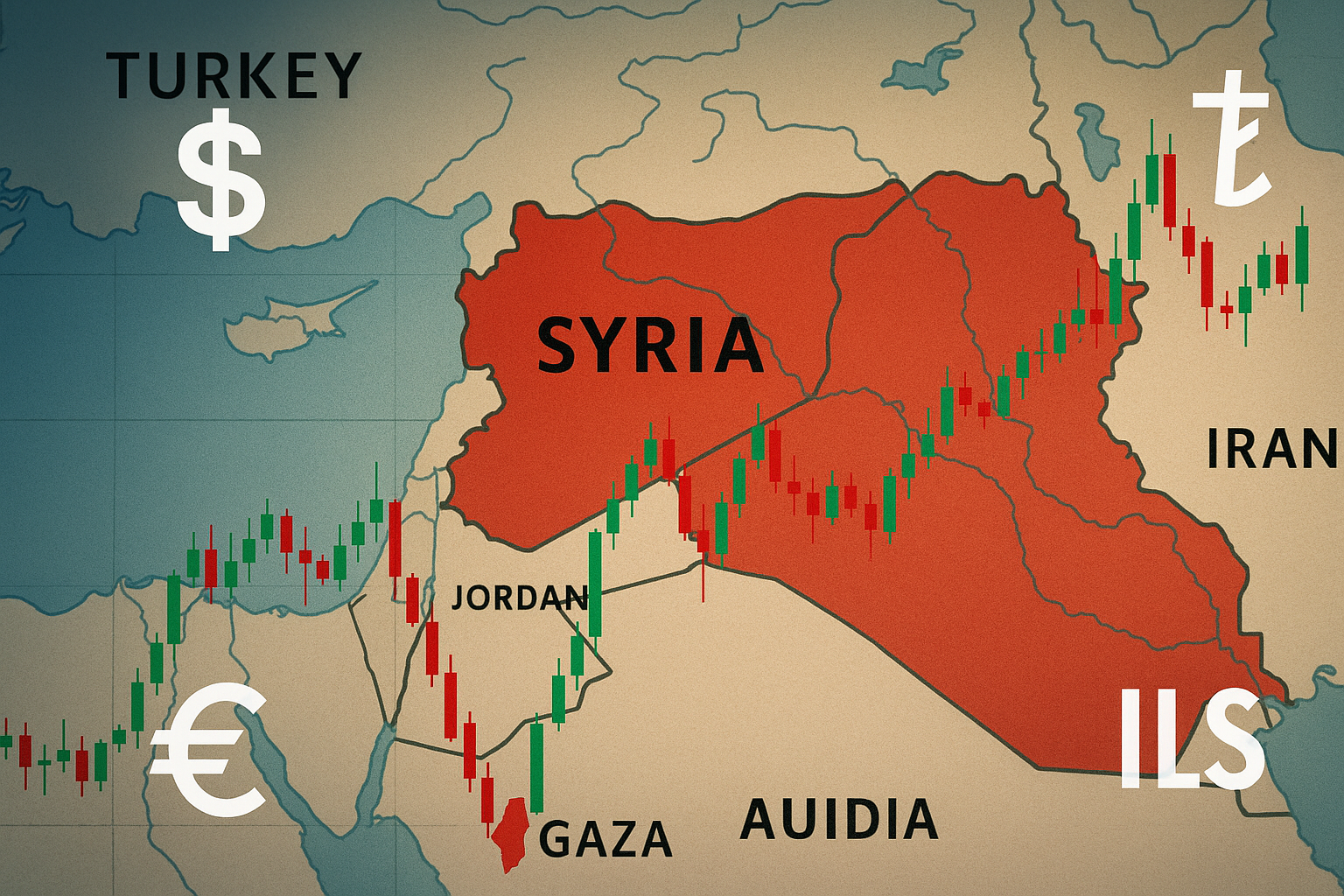

The forex market thrives on volatility—and few catalysts create more of it than geopolitical uncertainty. The latest developments in Syria’s economic reopening and the ongoing Palestine-Israel conflict are triggering fresh market reactions. As a trader with four years of experience in both forex and equities, here’s my breakdown of what you need to watch—and how to prepare.

Syria’s Economic Reintegration: Major Forex Ripples

U.S. Lifts Sanctions, Syria Eyes the Global Stage

In a groundbreaking turn, the U.S. recently announced plans to lift sanctions on Syria, paving the way for renewed foreign investment and trade activity. This move, detailed in Axios coverage of diplomatic talks, signals a new era for Syria’s economy, especially if peace stabilizes internally.

From a forex perspective, lifting these sanctions increases regional capital inflows, and that could strengthen currencies of neighboring economies—particularly Turkey and possibly Egypt.

Currency Reform: A Symbolic and Strategic Shift

Even more telling is Syria’s decision to shift currency printing operations from Russia to Germany and the UAE. Beyond a logistical change, this signals a deliberate move away from Russian influence and toward Gulf and Western allies. The new Syrian pound is expected to exclude the image of Bashar al-Assad, a symbolic pivot to a potentially more inclusive economy.

Palestine and Israel: An Ongoing Source of Market Tension

Economic Toll of War on the Israeli Economy

The war on Gaza has cost Israel an estimated NIS 250 billion, according to a detailed economic impact report. Military expenditures, slowed exports, and lost tourism revenue are all contributing factors. While Israel’s economy remains resilient, the long-term pressure on public spending and investor sentiment can’t be ignored.

Israeli Shekel (ILS) Resilience and What Could Crack It

Historically, the Israeli Shekel has remained stable even during intense regional conflict. That’s largely thanks to the central bank’s proactive market interventions and Israel’s strong institutional framework. Still, as the conflict drags on, we could see capital flight, weakening ILS against major pairs like USD and EUR.

Safe-Haven Demand: What Traders Should Be Watching

Geopolitical instability almost always boosts demand for “safe-haven” currencies. The USD, JPY, and CHF are classic go-to assets during global tension. If this week brings new escalations, expect upward pressure on:

USD/JPY USD/CHF XAU/USD (for those trading gold as a currency hedge)

Traders should monitor U.S. CPI and bond yields, as any dovish signal from the Fed may soften the dollar’s role as a haven—especially if coupled with strong Japanese or Swiss data.

Conclusion: Volatility Breeds Opportunity—If You’re Ready

This week’s geopolitical backdrop is a trader’s double-edged sword: plenty of risk, but just as much reward. Whether you’re scalping USD/TRY or swing-trading EUR/USD, the key is staying informed.

Review economic calendars, keep alerts on key news outlets, and lean into the charts with fundamentals in mind.

References

Axios. (2025, May 13). Trump met with top Syrian official amid Saudi-backed effort to end isolation. Reuters. (2025, May 16). Syria plans to print currency in UAE and Germany, ending Russian role. Arab Center Washington DC. (2024, April 18). The Estimated Cost of the Gaza War on the Israeli Economy. ExportPlanning. (2021, May 14). Forex markets respond quietly to new crisis between Israel and Palestine.